In the second part of the series on our Solutions funds, we turn to Portfolio Manager Sunniva Bratt Slette to understand how a Solutions portfolio is constructed to ensure value beyond return, based on companies that contribute to the attainment of SDG targets.

Team Solutions has been operating as a thematic investment team that covers global equities in Storebrand Asset Management since May 2020. The team manages four thematic funds that have sustainable investments as an objective. This means that the funds are categorized as article 9 funds, according to the EU Sustainable Finance Disclosure Regulation (SFDR), a set of EU rules for better comparability and less ESG confusion around financial products. How are such funds managed, and how are the portfolios constructed?

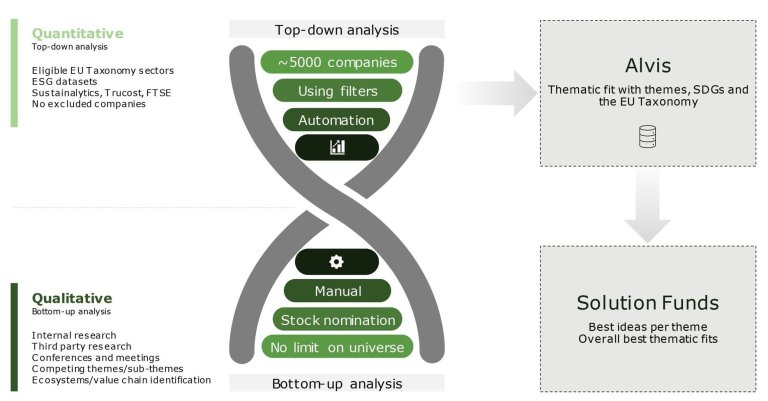

Alvis: The source of investment ideas

It all starts with compiling promising candidate companies in our Solutions-specific database. Alvis is the name of this database which summarises research on solution companies. The database is named after Allvís, which in Norse mythology means "the one who knows everything," or directly translated: "All-wise." Thematically strong companies are systematically categorised by solution theme and linked to the SDGs. The four themes are renewable energy, smart cities, circular economy, and equal opportunities. Also, the linked sub-themes, sub-categories, company characteristics like pure-play or diversified business model and relevant SDG target and indicators are mapped for each company.

The investment process

The investment process has three phases: It starts with research and analysis on a company or on a theme, continues with adding new companies when they comply with our standards, while continuing the work on improving the portfolio to decide whether companies should stay in our portfolio or give way to better investment ideas. Over time this process enables discipline, allowing the continuous monitoring of the portfolios and giving us the time for exploring and enhancing financial performance over time.

The ultimate target for team Solutions is to create Value Beyond Return: We seek both the consistent financial performance for clients and a nudge of financial flows to promising sectors that need stable growth in the coming decades to build a more sustainable development. Let’s have a deeper look into each phase:

1. Idea generation and qualification

The investment process starts with stock idea generation and qualification to Alvis. Since our team’s funds are thematic global equity funds, it makes sense to filter down the investable universe to a manageable number of companies before spending too much time on in-depth analysis. Our initial investment universe is vast, at our starting point we have around forty thousand listed equities – an initial filtering is highly necessary.

The filtering works in two parallel work streams: Firstly, a quantitative top-down approach by applying layers of acquired data on approximately five thousand companies which is found in the broad global index MSCI All Countries World Index (MSCI ACWI). Secondly, there is the qualitative bottom-up approach which opens up space for companies which are outside the benchmark. We also take account of companies that join the universe through initial public offerings (IPOs) or fall out of it because of bankruptcy or going private (for instance, following a merger or acquisition).

In the qualitative analysis, the portfolio managers are free to research both broadly and creatively. Typical "classical" methods are to attend webinars, seminars and conferences, company meetings or conference calls, reading annual reports and firm-specific updates. The more creative ones include thematic podcasts, books, magazines, media, site visits, inspection of solution companies that one comes across while traveling.

Examples of topics that the team has come across are flawless train services, a spectacular bike tunnel, a zero-emission construction site, water treatment systems, greenification to enhance resilient infrastructure, and electric autonomous ferries. Which company delivered the hardware, the software, the construction, project management and operation of the solution?

In the quantitative arm, data from external data vendors can provide indications of companies with strong ESG performance. This selection of companies is then further narrowed down by filtering in the companies that have revenue streams coming from the respective solution themes. In practice, the data is structured by combining data from different vendors in four views in Microsoft SQL Server Management Studio, so that a list of potential companies per solutions theme is generated on a daily basis.

The final list of companies that are candidates to Alvis, both from the quantitative and qualitative analysis, is then run through a scorecard model. The scorecard is an assessment which ranks companies on aspects like business model thematic strength, scalability, quality, and a check on Do No Significant Harm criteria beyond what is already filtered out through data vendor and internal exclusions.

To complete our checks, we get assistance from the Risk and Ownership team in Storebrand Asset Management. They provide us with expert assessments in cases where companies are involved in serious human rights violations, corruption or environmental damage. We draw further insight from data vendors to understand potential unwanted product exposure to ethical exclusion, like weapons, tobacco, coal and alcohol. Depending on the Scorecard, a company will either be accepted to Alvis, denied entry and thereby remain uninvestable for the solution funds, or placed on a list of stocks that should be monitored.

A company can be placed in the monitoring list for a number of reasons: either it is currently private, and thereby not investable for a fund that only takes listed equities, or it is currently not aligned with Storebrand Asset Management’s investing thresholds, for instance when a diversified renewable energy company has exposure to fossil fuels above the permitted 5-percent-revenue threshold.

2. Stock selection and portfolio construction

Once the promising candidates have been accepted to Alvis, the portfolio managers in team Solutions seek to find actual investment candidates to get exposure to a diversified set of solution companies whose business model hits the solutions theme of their respective funds. The target is to address different challenges across value-chains for the four solution themes. A quick method to find relevant companies for further financial analysis is to extract data from Alvis by peer groups in the wanted sub-category, for instance "water treatment" under Smart cities, "recycling" under Circular economy, "grids and infrastructure" under Renewable energy, or "access to healthcare" under Equal opportunities. Once the peer group is set, a financial assessment of the firm's economic health is initiated. Several tools can be utilised to achieve an overview, depending on investment style.

Team Solutions' method is firmly built on a foundation of thematic strength in interplay with momentum and growth strategies. A long term perspective is very pronounced for a sustainability oriented strategy like team Solutions' fund, given the inherent logic of an expected long term sustainable growth in the portfolio companies, both financially and thematically. An equity model assists the portfolio managers in evaluating the financial outlooks for the companies, while tools like Bloomberg, Factset, Annual Reports and Quarterly updates are helpful to compare key ratios for insight in valuation.

Portfolio construction is an iterative process. One of the main targets is to balance the portfolio to minimise risk and optimise potential returns. Optimisation can relate to the portfolio companies' liquidity, geographical and thematic diversification and to maintain exposure to the high conviction companies that are well positioned in attractive business segments. Historical profitability and prospects of a healthy economic development in the future weigh heavily, with exposure to large and mature businesses. A smaller part of the portfolio can consist of micro positions in young, pure-play companies with innovative products and services.

Once the highest conviction companies are set, a model portfolio is updated with all the companies with respective identifiers with the desired weight in the portfolio is uploaded to an internal trading application.

3. Risk management and trade execution

The daily trading for team Solutions is handled by a market operator, the team for Global Equities, who also manage Storebrand's index funds. Once a model portfolio has been updated, trading will be performed on in- and out-flows until the desired wights are reached.

Inherently, the portfolio construction and daily monitoring of the portfolios focuses on reducing unintended risk. Through continuous monitoring and research on company news, both the portfolio managers and market operator in the Index Quant Team have an alert eye on any abnormalities. The fund aims to be diversified across fundamental risk factors. Cash management and handling of corporate actions is included in the daily monitoring.

The Solutions fund family is organised with a neat interplay between the solution themes. Storebrand Global Solutions works as the umbrella with exposure to all four solution themes, whereas the more thematically concentrated funds Storebrand Renewable Energy, Storebrand Smart Cities and Storebrand Equal Opportunities provide pure exposure to one solution theme, though with a broader set of sub-themes.

All the stocks in Storebrand Global Solutions can be found in the sub-themed funds, typically 10 – 20 stocks out of a portfolio with 40 – 60 stocks in the thematic funds. The thematic funds grant an early entry point to a company, enable close dialogue and monitoring which in turn could lead to a potential inclusion in Storebrand Global Solutions.

Primer on different investment strategies

- A solution company has products or services that contribute positively to the UN Sustainable Development Goals (SDGs), without causing significant harm to society or the environment.

- Growth: Stocks in companies which are expected to grow earnings and sales faster than the market average. Characterized by high valuation, e.g. by financial ratios like P/E (price/earnings), often without dividend payments.

- Momentum: The tendency of security prices to continue rising or falling over a set period of time. The strategy refers to trading in securities with an upward trend in stock pricing, and selling when the price seems to have peaked.

- Thematic: Exposure to desired megatrends by investing in specific market segments. The niche approach to the selected themes can include multiple market sectors.