As part of Storebrand Asset Management’s trip to Japan, combining our participation in the PRI in Person conference with meetings with our portfolio companies, we conducted several in-person meetings following up on our ongoing engagements with Japanese steel producers. The steel engagements make up an important step in our drive to decarbonize the steel industry, which is highest carbon emitting sector in our portfolio.

The meetings matter in the context of Storebrand’s objective to achieve real-world emission reductions as well as to fulfil our own climate commitments and targets. We believe in engaging with the top emitters in our portfolio to drive impactful change.

During this trip, in October, Victoria Lidén, Storebrand’s senior sustainability analyst, met with Nippon Steel and JFE Holdings in Tokyo. The meetings marked the next step in our two-year long engagement with the two companies. Our main collaboration partners, Australasian Centre for Corporate Responsibility (ACCR) and Corporate Action Japan (CAJ) were also present in these multi-stakeholder meetings.

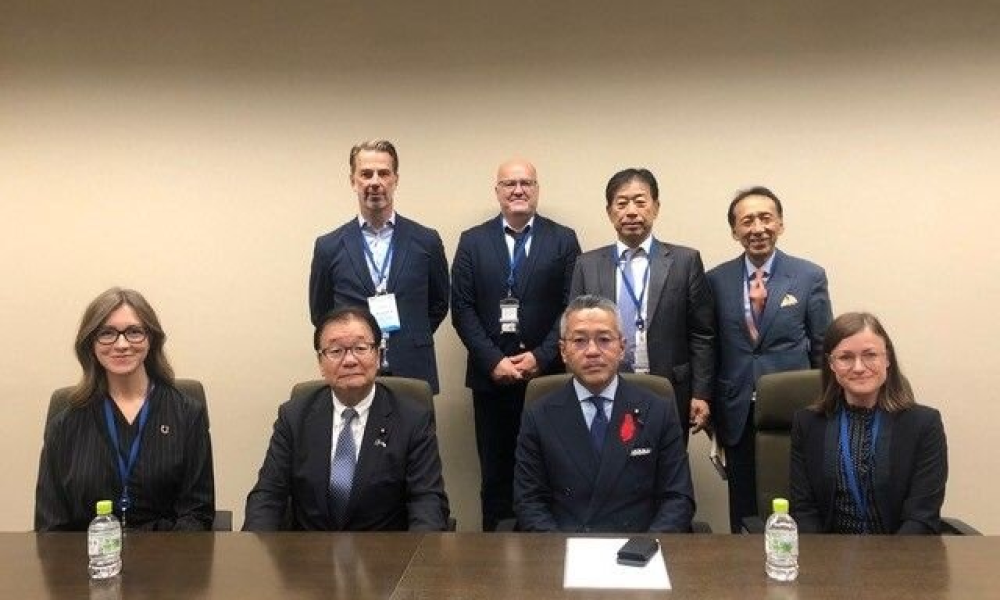

The following day, Lidén and representatives from our collaboration partners met members of the Japanese Parliament, to discuss the transition and decarbonization of Japan’s steel industry. We highly appreciated this opportunity to engage with legislators and share the investor perspective on steel decarbonization with the parliament members.

Before our working trip to Japan, both Nippon Steel and JFE Holdings announced that they would convert their blast furnaces into electric arc furnaces in the next couple of years, a promising development given that at the beginning of 2022, when Storebrand started its engagement with companies, there were no such plans. The conversion will significantly cut down the production-related carbon emissions.

We plan to continue our engagement with the companies, as they work towards financial growth and transition goals.

Following up steel engagements

Meeting members of Japanese parliament in connection with our 2-year-long steel engagement.

By

ARTICLE

·

PUBLISHED 12.02.2024

Latest insights

Standing Firm on Sustainability

27.03.2025 Jan Erik Saugestad, CEO, Storebrand Asset ManagementThe current spotlight on ESG highlights its complexities but also strengthens our view that investing sustainably is vital for a healthy planet, ...

10 years strong

19.03.2025 Gustaf Linnell, Head of Fixed Income, Storebrand Asset ManagementHow Green Bond funds have gone from niche to mainstream in a decade

Changes to our extended exclusion criteria

18.02.2025 Storebrand Asset ManagementMarket-oriented screening will now be assessed in-house as part of the Storebrand Exclusion Policy