Storebrand is committed to eliminating commodity-driven deforestation from our investment portfolio, and to assess and disclose our exposure to deforestation risk. This ambition is articulated in our deforestation policy and as part of the Finance Sector Deforestation Action (FSDA) joint commitment. To effectively assess and disclose exposure to deforestation risks, we leverage the Forest IQ data platform, a comprehensive resource developed by Global Canopy, Stockholm Environment Institute and Zoological Society of London.

Forest IQ Data Tool Overview

The Forest IQ data platform contains information on more than 2000 companies’ exposure to commodity-driven deforestation and their efforts to eliminate deforestation, conversion and associated human rights violations from their operations, supply chains and financial relationships. It includes data from the following datasets: CDP, Deforestation Action Tracker, Forest 500, SEI York, Trase, ZSL SPOTT and RSPO. The forest risk commodities currently covered are palm oil, soy, beef, leather, timber, pulp & paper, natural rubber, cocoa, coffee, gold and coal. While the coverage in number of companies and commodities is expected to continue to grow, Forest IQ already covers most companies and financial institutions in our investment universe with material exposure to commodity-driven deforestation.

Metrics Used in Storebrand’s Risk Screening

Storebrand employs several key metrics based on Forest IQ to evaluate and disclose deforestation risks:

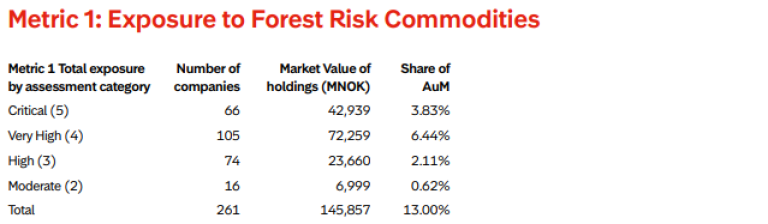

- Metric 1: Exposure to Forest Risk Commodities

This metric assesses the level of exposure of our portfolio to companies potentially linked to deforestation. Forest IQ places companies in different exposure categories, by estimating volume of commodities sourced or produced with risk of deforestation. (Financial institutions are assessed by estimating the amount of finance provided to companies with exposure to deforestation.) We report on the number of companies, value of holdings, and percentage share of our total equity and bond investments held in companies that fall in the categories with the following exposure levels: Critical, Very High, High, and Moderate. This provides a picture of how much of our portfolio is potentially exposed to deforestation risks.

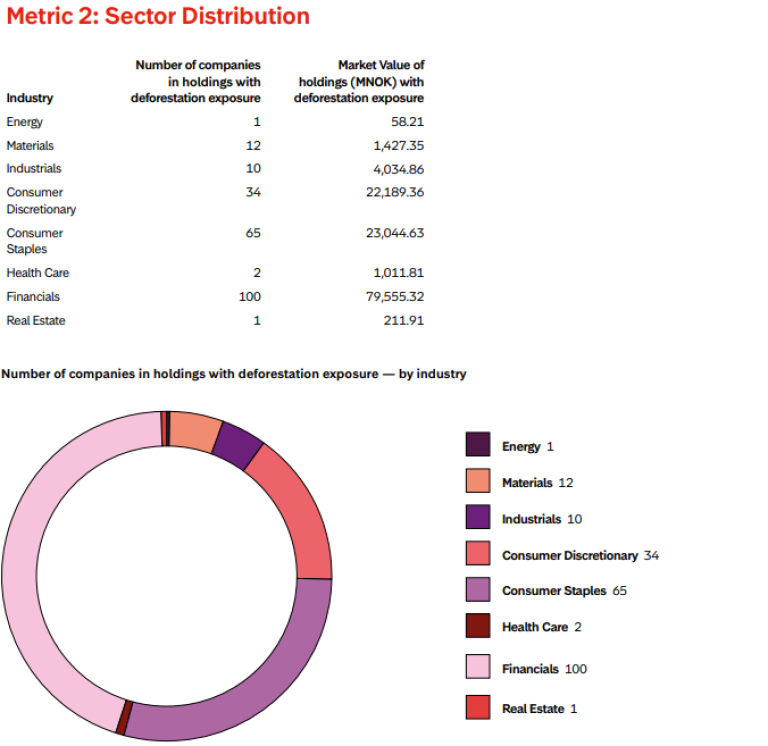

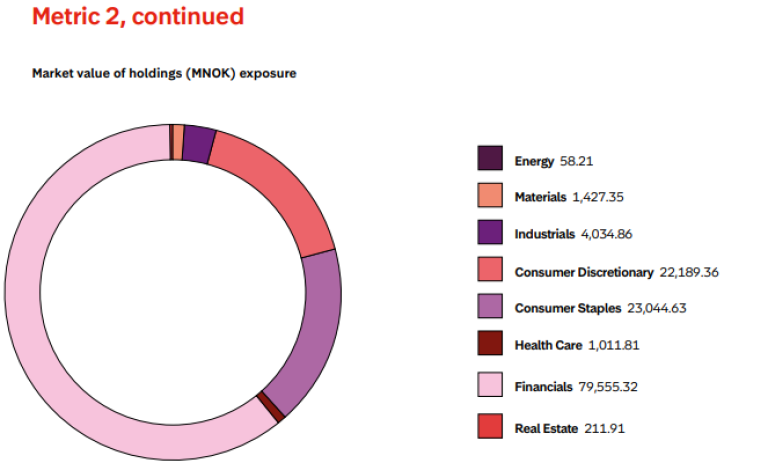

- Metric 2: Sector Distribution

This metric analyzes the distribution of companies identified under Metric 1 across different Global Industry Classification Standard (GICS) sectors. This helps in understanding which sectors in our portfolio are most exposed to deforestation risks.

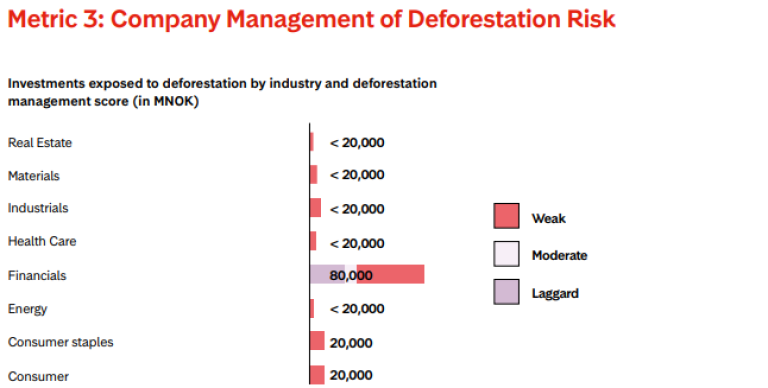

- Metric 3: Company Management of Deforestation Risk

Metric 3 evaluates how well companies manage deforestation risks, categorizing them into five performance tiers: Laggard, Weak, Moderate, Advanced, and Leader. This is done by assessing the quality of their commitments, actions taken and quantifiable progress reporting. For companies identified under Metric 1, we disclose the number of companies and value of holdings distributed across these performance categories. This metric provides insights into the effectiveness of companies' deforestation risk management practices, which helps inform our stewardship efforts

Developing screening methodology

When Storebrand first screened our portfolio for deforestation risk in 2020, we designed an inhouse screening methodology based on the tools Forest 500 and Trase. As Forest IQ includes data from both these tools, in addition to others, we are now able to assess a larger share of companies in our portfolio. While this change in data availability and methodology makes comparisons with earlier iterations difficult, it improves transparency, stewardship efforts and risk management related to deforestation. It should be noted that currently available data do not allow attributing actual deforestation impact to individual companies, but estimates risk exposure and assesses company performance to avoid deforestation, conversion and associated human rights abuses. We will continue to perform annual deforestation risk assessments and to disclose the results and any further changes to methodology and data sources.