The EU’s new sustainability reporting directive could transform the landscape for sustainable business activities, through greater transparency, but appropriate due diligence still needs to be at the core.

The CSRD may potentially have significant implications for the finance sector, as it will provide more and better information for investors to assess the sustainability risks and opportunities of portfolio companies, and to make informed decisions that align with their own sustainability preferences and goals. CSRD aims to improve the quality, consistency, and comparability of sustainability information disclosed by companies, and make it more accessible, predictable and useful for investors, consumers, regulators, and other stakeholders. The standards will hopefully lead to sustainability information that is more reliable, comparable, and verifiable, and that can be integrated with financial information.

It may also enable investors to better monitor and engage with companies on their sustainability performance, and to hold them accountable for their impacts. Moreover, CSRD may facilitate the development and growth of sustainable finance products and services, such as green bonds, ESG funds, and sustainability ratings, by providing a common and credible basis for their evaluation and verification.

Principle vs. practice

However, the jury is still out, so to speak, as to how the CSRD will be implemented in practice by companies, and how useful it will be to investors. The regulation has two mandatory KPIs (or ESRS) on General Information (ESRS 1) and General Disclosures (ESRS 2). The remaining 10 KPIs (5 Environmental KPIS, 4 Social KPIs and 1 Governance KPI) are voluntary and based on a materiality assessment by the company. If, for example, a company does not perceive the social KPI on affected communities (ESRS S3) as material for their business, they are not required to report on this, however they need to provide an explanation of the conclusions of its materiality assessment on this topic.

Inconsistencies

Another potential limitation is that some of the topics that are of focus for investors, and required by SFDR regulation, may not be fully harmonised with CSRD and therefore not reported on. For example, the KPIs on Biodiversity and Ecosystems (ESRS E4), or on workers in the value chain (ESRS S2) may be more challenging and/or costly for companies to evaluate and report on. This can lead to a data and information vacuum for investors that are wanting to report on risks to these indicators across their portfolios, or that need this information for identifying and targeting companies for engagement on these topics.

Finally, the CSRD should be viewed in light of the upcoming CSDDD. The scope of applicability of the CSRD is all large and listed companies in the EU (as well as non-EU companies that generate over 150 million Euro revenue). On the other hand, the scope of applicability of the CSDDD has been watered down, and is now more limited, applying to companies with a turnover above 450 million Euros and over a thousand employees.

Also dropped was the high-risk sector approach, which would have included companies that do not meet the revenue and employee criteria, but which operate in sectors recognised for having high human rights and environmental risks.

Consequently, CSRD will cover roughly 50,000 companies, while CSDDD will cover roughly 5500, a magnitude of order smaller.

Moreover, CSRD is a disclosure and reporting regulation, similar to SFDR, whereas CSDDD legally requires companies to investigate and address how their operations and supply chains impact the environment and human rights. The main objective is not reporting on status, but to take concrete action to stop harmful effects of its business activities. Regulations covering the broadest coverage of companies thus focus on disclosure of impacts, rather than mandating companies to take responsibility for their impact.

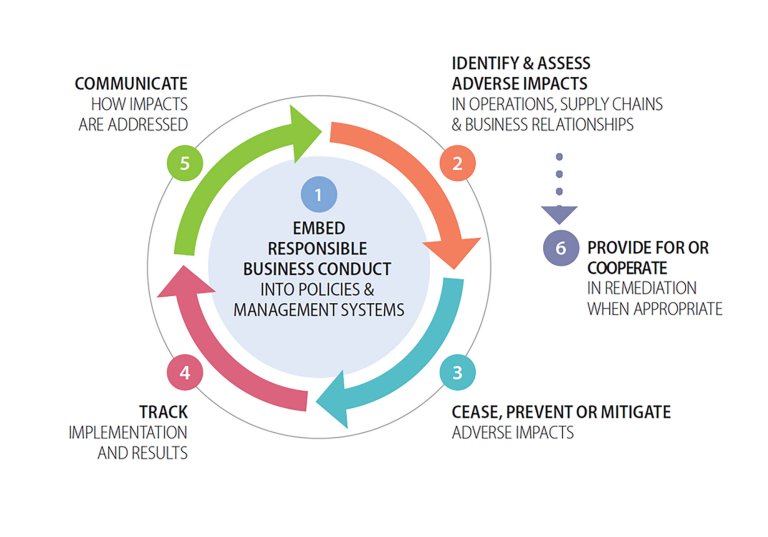

Viewed from the perspective of the widely accepted OECD due diligence guidance for responsible business conduct, the CSRD would require 10 times as many companies to take action on communication, the fifth stage of the process, compared to the number required to act on a much earlier-stage step, identifying & assessing adverse impacts, which as the second step should set the foundation for later stage steps such as communication and reporting.

Both the CSRD and CSDDD regulations serve important purposes for investors: however, the fact that the scope of the CSDDD is reduced to much fewer companies than the CSRD, implies that the compulsory due diligence requirements will cover fewer companies. This would impair the quality and comparability of the data reported under the CSRD; data that is important for investors to make informed decisions.

Related content

- In Focus Q1 2024: Transparency

- Yes, CSDDD isn’t perfect - but it’s still a great start

- Sustainable investment