We recently had the pleasure of attending the renewable energy conference RE+ in Anaheim, CA. With 40,000 attendees and 1,350 exhibitors, RE+ stands as the largest renewable energy event in North America. This year was the 20th anniversary of what began as Solar Power International, a purely solar-focused event, and has since evolved into RE+ to encompass a broader range of renewable sectors. Today, the event highlights various aspects of the renewable energy industry, including solar, energy storage, hydrogen, wind, microgrids, and electric vehicles.

Over three days, we engaged in meetings with company leaders from our current holdings and potential prospects, as well as analysts and investors. We also had the opportunity to speak with exhibitors representing a wide spectrum of the renewable landscape.

The event’s growth ̶ attendance jumped from 19,000 to 40,000 in just a four-year span between 2019 and 2023 (1) ̶ underscores the accelerating momentum behind the energy transition, bolstered by the Inflation Reduction Act and the push towards domestic manufacturing of renewables in the U.S.

Solar has emerged as a dominant sector. Ember estimates that at the current rate of additions, the world will install 593 GW of solar panels this year. That is 29% more than was installed last year, maintaining robust growth even after an estimated 87% surge in 2023 (2).

However, despite strong global solar deployment listed solar companies have performed poorly especially since peak levels seen in 2021.

In this spotlight, we present three key takeaways from RE+ concerning the solar industry.

Utility Scale Solar: Strong Long-Term Growth Prospects Despite Short-Term Challenges

During our meetings we sensed that the demand for solar remains good heading into 2025 due to energy demand growth and decarbonization.

However, in the utility-scale solar sector, project delays have been a significant challenge, leading to lowered full-year guidance for companies in this space.

Several reasons have been cited for these delays, including permitting issues and interconnection challenges. While project delays seem to have eased antidumping and countervailing duty (AD/CVD) investigations into solar cells and modules imported from Cambodia, Malaysia, Thailand, and Vietnam and the upcoming election in the US are causing some uncertainty in the near term.

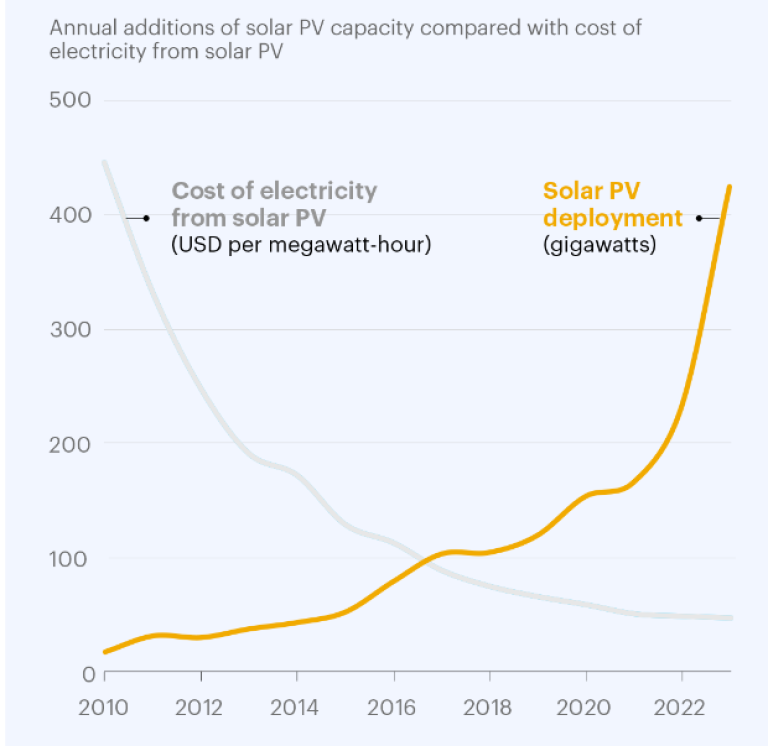

Longer-term interconnection and permitting issues are issues that need to be addressed and the availability of high voltage equipment. As data from the IEA suggests, the cost of electricity generated from solar panels (or solar PV) has fallen dramatically in recent decades. This has contributed to a boom in solar PV deployment, with global capacity now growing at a historic pace. Going forward, the key for future market growth of solar will be to ensure that countries have sufficient grid capacity to transport power to where it is needed, as well as develop battery storage capacity to complement solar outside of the sunniest hours (2).

Residential Solar: Europe Shows No Recovery Signs, While US Moves Forward

In the residential solar sector, several negative factors have impacted companies with exposure to this space, initially in the USA and later in Europe. In the USA, a new regulation came into effect in California, a major market for this segment, in the second quarter of 2023. This regulation changed how much customers are paid for the excess electricity they produce, favoring the installation of solar plus storage but making conditions less favorable for solar-only installations.

Additionally, many households that install solar systems fund their investments through financing schemes such as loans or leasing. Higher interest rates have negatively impacted the economics of these investments. Companies in this segment have transitioned, from a period of robust growth and high demand, to low growth and high inventories that need to be worked through.

During our meetings, we gathered that the US market is showing sequential improvement, with growth expected to pick up next year, aided by stable/higher utility pricing, expected declines in interest rates and availability of products eligible for domestic content adders. Conversely, the European residential rooftop market remains weak in the near term, with no strong signs of an imminent turnaround. Low power prices and policy uncertainty mainly around net metering (a billing mechanism that credits solar energy system owners for the electricity they add to the grid) in the Netherlands was cited as one of the reasons. For equipment manufacturers, the slower rate of rooftop solar deployment along with fierce competition, mainly from Chinese manufacturers, has created a challenging environment.

US Election: Full Repeal of IRA Not in The Cards, But Near-Term Uncertainty Persists

With the upcoming presidential election in the US, this topic naturally surfaced during our meetings. The election outcome has significant implications for the sector, particularly regarding the Inflation Reduction Act (IRA), taxes, regulatory changes, trade policies, and tariffs. Simplistically, a Harris win is seen as maintaining the status quo, while a Trump win introduces more uncertainty. However, predicting the actual impact on the sector is complex, as historically the sector’s performance has not been directly tied to the election outcome. Also, a detailed discussion regarding specific impact on the distinct parts of IRA is out of scope for this report.

During our meetings, the consensus view seems not to be a full repeal of the IRA. A full repeal of the IRA is only likely under a Trump election victory together with Republican majority in the senate and the house. However, even a partial repeal could weaken the IRA, posing a negative risk to the renewables sector. Certain parts of the sector, such as wind subsidies and EV credits, are perceived to be more at risk following some of Trump’s comments. Conversely, other areas like the Investment Tax Credit (ITC) are seen as less at risk, given past bipartisan support. Additionally, many clean manufacturing investments have been directed to Republican states, successfully onshoring manufacturing jobs to the US, which reduces the risk to manufacturing credits.

We left RE+ with an optimistic outlook on the long-term prospects of the sector. However, challenges such as interconnection issues could slow down progress and need to be addressed locally and monitored from an investor's perspective. Lower interest rates are expected to gradually support the development of the residential solar space, while the outcome of the US election will be a key event contributing to near-term uncertainty.

Sources

2 Solar power continues to surge in 2024 | Ember (ember-climate.org)