Impact investing has emerged as a powerful force to address global challenges such as climate change, poverty and inequality. The Global Impact Investing Network (GIIN) estimates that more than 3,900 organisations currently manage over $1.6 trillion allocated towards solutions-orientated investments, representing compound annual growth of 21% since 2019[1].

As impact investing has expanded into the more mainstream areas of the capital markets, assessment of its effectiveness has become increasingly important. As well as ensuring transparency and accountability, quantifying impact allows investors to track progress toward goals, alignment with asset owners’ intentions and demonstrate the real-world value of their investment decisions. Accurate measurement is also critical to building trust in the industry – for example by dispelling concerns about ‘impact washing’ – and ensuring that resources are allocated efficiently, which will hopefully attract even more capital to help solve the significant challenges we face.

Assessment anomalies

Unlike traditional financial performance metrics, however, which are generally standardised and well-understood, quantifying social and environmental outcomes is relatively new and fraught with complex challenges.

A major issue is the lack of standardisation. Improving education outcomes, for example, requires very different metrics to tackling biodiversity issues. Social and environmental impacts are multi-faceted and often context-dependent, which makes comparing investments challenging.

Another obstacle is the difficulty of attributing outcomes to specific investments. Change often results from a combination of factors, making it hard to isolate the impact of individual actions and assess causation. There can be a lack of transparency and demonstrating a clear link between positive impact and financial performance is an additional barrier to overcome for impact investing to expand further into mainstream markets.

The costs of impact measurement also create barriers that can detract from financial returns and overwhelm stakeholders with complexity. Overly basic frameworks, on the other hand, risk oversimplifying impacts or missing important nuances.

Upright solution

One company helping to overcome these challenges is Upright. The innovative Helsinki-based start-up has built an open-access database to help investors and other stakeholders quantify the real-world net impact of companies. Launched in 2017, the Upright Project is currently used by over 250 organisations to assess 50,000 businesses globally.

Upright’s model uses advanced data science and machine learning to analyse over 250 million scientific articles, company disclosures and public information sources to quantify the science-based impact of around 150,000 products and services. That knowledge is then used to produce impact scores for companies and funds.

Importantly, these scores include both positive and negative effects across four dimensions – environment, health, society and knowledge – to provide a holistic view of a company’s footprint. We have been using Upright since the summer as an input into the investment process for Storebrand’s solution-focused equity funds, which are centred on renewable energy, smart cities, circular economy and equal opportunities – themes complemented by the Upright model.

It provides us with data-driven impact scoring across a range of metrics with data that can be compared across industries and company sizes. As with all third-party data tools, we don’t always agree with Upright’s assessment but used alongside other inputs and our own analysis, the model provides a valuable appraisal of companies in our investment universe and our portfolios in aggregate.

Holistic view: Upright’s net impact assessment of Storebrand Global Solutions |

|

Source: Upright |

As the above analysis demonstrates, the model’s focus on net impact is a key differentiator. It considers both costs and benefits in assessing net value creation – including across entire company value chains – in order to inform decision-making on capital allocation. At a portfolio level, Global Solutions ranks most positively on societal benefits, notably infrastructure and stability, whilst the environment, notably GHG emissions, and knowledge (scare human capital) are the fund’s largest costs. This aligns with our view that it is important to recognise that all goods and services society produces have a cost – consider the factory emissions and skilled labour needed to produce electric cars, for example – which must be considered alongside their social benefits.

SDG alignment

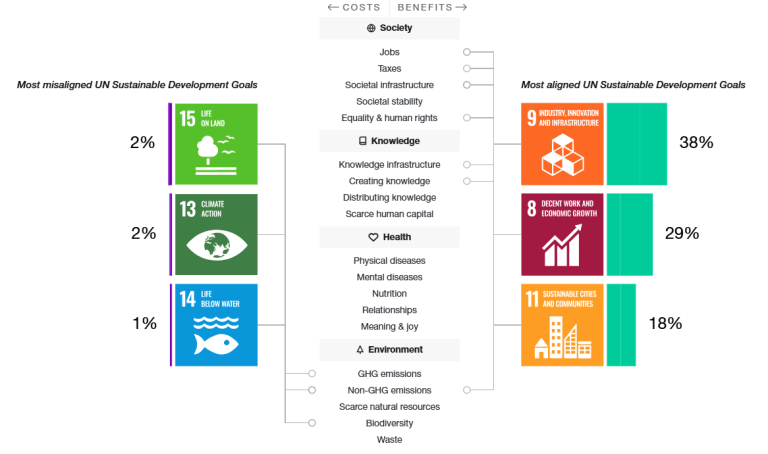

Another output of Upright’s model is company alignment with achieving the UN Sustainable Development Goals (SDGs), based on revenue assessment across the 17 goals and 169 targets. With the global financing gap to achieve the SDGs having widened from $2.5 trillion annually pre-COVID to $4.2 trillion in 2024, this is particularly useful to help find companies that are well-positioned to deliver these important objectives[2].

As the SDGs are central to the portfolio construction of our solutions funds, this also provides useful benchmarking at an aggregate level. Storebrand Global Solutions, for example, is largely SDG aligned with the portfolio scoring particularly highly on Goals 9 (industry, innovation and infrastructure), 8 (decent work and economic growth) and 11 (sustainable cities and communities) as can be seen below.

Goal alignment: Upright’s UN SDG assessment of Storebrand Global Solutions |

|

Source: Upright |

Third-party endorsement

For our clients, Upright provides third-party benchmarking of our portfolios. Storebrand Global Solutions has a net impact score of +37%, placing it in the top 4% of Upright’s universe of over 42,000 funds[3]. Given the model’s data-driven assessment of real-world net impacts, this is valuable endorsement of our view that transparency and thinking holistically about companies’ products and services is key to solving our most significant environmental and societal challenges.

Looking ahead, Upright has ambitious plans to increase its coverage universe and provide data on all companies globally with over 10 employees and an internet presence. Also key to its goal of creating a ‘Wikipedia of company impact’ is a commitment to its model remaining publicly available, with Upright believing that science-based, open-source information offers an important check on company-led disclosure and a way of incentivising huge shifts in capital allocation.

We believe that investing in companies making a positive net impact that are well-positioned to achieve the UN SDGs will help ensure a better future and deliver optimal risk-adjusted financial returns over time. Given the complicated challenges of assessing impact and goal alignment, tools like Upright will be vital to achieving these important objectives.

Sources:

[1] https://s3.amazonaws.com/giin-web-assets/giin/assets/publication/giin-sizingtheimpactinvestingmarket-2024.pdf

[2] UN Financing for Sustainable Development Report 2024

[3] Upright. Net Impact Ratio of all positive and negative impacts. Defined as Positive Impacts - Negative Impacts / Positive Impacts.