A recognition that Scope 1 and 2 emissions provide an incomplete picture of climate risk has led regulators and industry bodies to focus on incorporating Scope 3 data into portfolio decarbonisation pathways. EU-defined Paris Aligned Benchmarks (PABs), for example, must now incorporate indirect value chain emissions into their annual 7% decarbonisation requirement for most sectors.

Despite their laudable aims to avoid "counterintuitive results", "prevent greenwashing" and "reallocate capital towards climate-friendly investments", the inclusion of scope 3 data provides a sub-optimal indication of portfolio climate risk exposure and causes perverse allocation decisions by investors.

The financial services industry is fixated on the need for better Scope 3 data to improve investment decision-making, but data quality is not the only problem. The problem lies in the systematic application of a measure, Scope 3, which was not designed to evaluate company transition risk exposure for all sectors – and in the absence of reliable Scope 4 data.

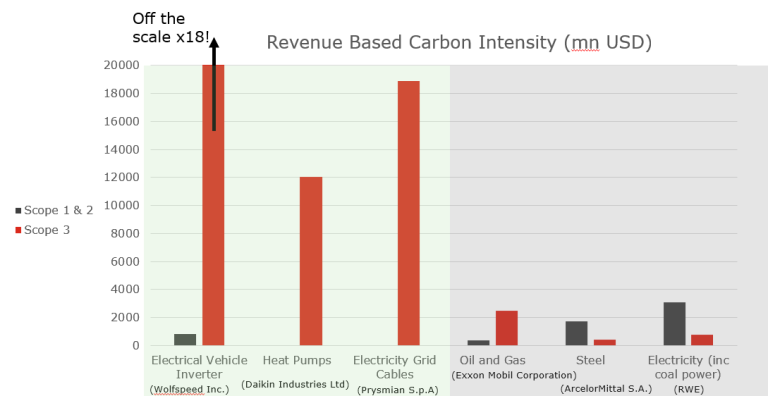

For many sectors, like fossil fuel production, adding Scope 3 gives a far better proxy for a company’s climate risk than using Scope 1 and 2 alone, and Storebrand welcomes the reporting of Scope 3 data from our investee companies. However, for companies offering climate solutions based on electrification, adding Scope 3 gives a highly distorted impression of climate risk, both for the company in question, and also for an investment portfolio investing in the company.

Set by the GHG Protocol, the Scope 3 accounting framework aims to help businesses make emission reductions in their value chains, rather than informing investors' decision-making. SBTi's increased emphasis on Scope 3 inventories and targets is similarly helpful in facilitating real-world emissions reductions.

The Scope 3 emissions standard is complex, with 15 underlying categories covering a diverse range of upstream and downstream activities plus substantial differences in materiality across industries. Our analysis indicates that the major sources of Scope 3 emissions for nearly two-thirds of companies in the MSCI World Index derive from only two categories, purchased goods and services (Category 1) or the use of sold products (Category 11) [1].

Paris mis-aligned

Investments in economy electrification must multiply seven-fold by 2050 for alignment with the IEA net zero scenario [2], with electrified heat, transport and grid expansion requiring the greatest capital. Current Scope 3 reporting standards require companies producing heat pumps, EV technology and grid cables to report the total emissions from electricity consumed across the lifetime of their products. Companies tend to estimate those lifetime emissions using a CO2e emissions factor based on the existing, fossil-powered grid.

This makes sense as an indicator of where value chain emissions reside – so companies seek cleaner, greener providers – and to understand the financially-material risk associated with investing in fossil fuel companies, as their products must ultimately be replaced by new energy sources.

However, for companies facilitating electrification, Scope 3 emissions from projected lifetime product-use (which can often dwarf those from oil and gas majors) are not a sensible measure of climate risk. Our analysis shows that their mis-use causes many PAB index trackers to zero-weight companies in these growth industries needed for a Paris-aligned economy, in direct contradiction with the benchmarks' capital allocation goals.

[1] Storebrand analysis of 968 companies in MSCI World (accounting for 76% of index weight) with CDP sourced Scope 3 data in Bloomberg, as at March 2023.

[2] Bloomberg New Energy Finance: Energy Transition Investment Trends 2023.

Reported Carbon Intensity ≠ Climate Transition Risk

Source: Storebrand, Bloomberg. Company data for Financial Year 2021. Note: EVIC based Carbon Intensity metric required by EU for PAB/CTB regulations. We use revenue-based carbon intensity in portfolio construction and client reporting due to volatility and growth style bias associated with EVIC based metric, as observed in our internal research.

Dubious data

This Scope 3 data challenge is closely connected to the absence of reliable Scope 4 data. For the economy electrification product examples provided in this paper, Scope 4 figures would present a large positive signal resulting from the "avoided emissions" achieved. For example, the avoided "Scope 4" emissions from using a heat pump, relative to a gas boiler, vastly outweigh the use of product "Scope 3" emissions from the heat pump, even in regions where the electricity grid is emissions intensive.

In an ideal world, Scope 3 and Scope 4 could be combined with Scope 1 and 2 for optimal portfolio alignment outcomes. But Scope 4 is even more difficult to define than Scope 3 - as it involves assessing the full range of climate solutions and all potential future climate outcomes - and it is too open to manipulation for corporate reporting purposes. This approach requires specialist oversight to ensure proper distinction between categories of Scope 3 emissions and avoid further unintended consequences.

Some Scope 3 emissions, such as electricity generation, may be out of the control of the company in question but will be expected to reduce over time as the grid decarbonises. Other Scope 3 emissions, such as F-gases in heat pump technology, are a potential area for engagement with companies and policymakers to ensure good practice, avoiding leakages and managing end of life disposal, and ultimate phase out.

A better near-term solution would be to adjust the Scope 3 emissions accounting framework. Category 11, use of product, could be separated into two parts: Category 11a would deal with combustion-related and GHG leakage emissions while Category 11b would address indirect emissions from consumed electricity. Investors could then choose to ignore Category 11b to improve alignment between Scope 3 emissions and company climate risk.

The focus on rigid decarbonisation pathways as a defining feature of "Paris alignment" is discouraging investors from aligning with the technological transition to greener solutions. Economy decarbonisation is crucial but uncritical use of data must not hinder rapid uptake of climate solutions. With investors increasingly encouraged to report Scope 3 emissions, we urge them to consider the source and category of those emissions for capital allocation purposes.

Corporate emissions datasets should not be used at face value. Thoughtful, expert use of climate data is required to understand portfolio risk exposures and allocate capital in line with the goals of the low carbon transition.

This opinion piece is based on a research paper by Storebrand Asset Management: