"Nature is the world’s most generous service provider, but most of these services that nature provides are for free," said Pavan Sukhdev, former head of UN Environment Programme’s Green Economy initiative and former president of WWF International at our internal event hosted Monday morning, January 22nd.

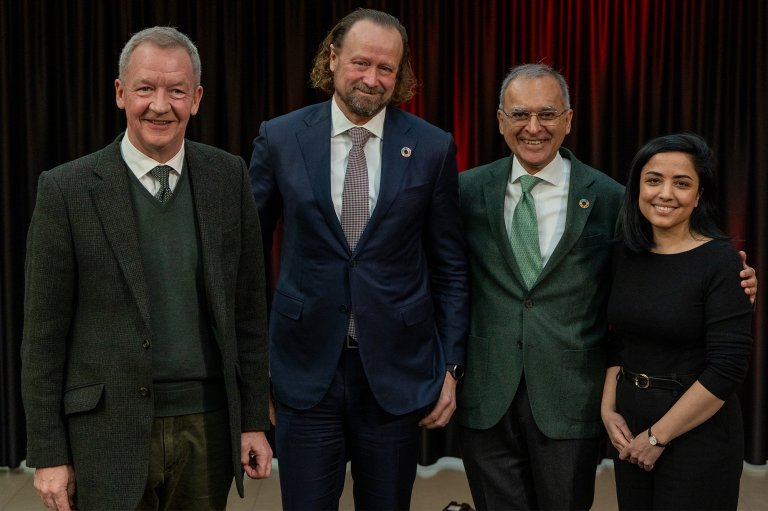

Our roundtable titled "Putting Nature on the Balance Sheet" brought together Mr. Sukhdev, Idar Kreutzer, one of the expert members of the Norwegian Commission on Nature Risk, and Jan Erik Saugestad, CEO of Storebrand Asset Management, and focused on the economics of biodiversity and ecosystem services.

Many of the resources that corporations regularly use and extract such as water, minerals and trees exist in the public space, and therefore come cost-free, emphasized Mr. Sukhdev in his talk. Internalizing these externalities or assigning an economic value to them can help corporations measure, report, and manage their social and environmental impacts.

Mr. Saugestad, on the other hand, emphasized that through investments and dialogues with both investees and policymakers, Storebrand will continue to strengthen its actions on nature, including the application of the precautionary principles.

Mr. Kreutzer's talk offered a preview of the upcoming report by the Norwegian Commission on Nature Risk and emphasized the need for bolstering trust-based systems of information sharing and collaboration between and among investors and companies.

We thank Mr. Sukhdev and Mr. Kreutzer for joining us on a very icy morning in Oslo, and we are excited to pursue other collaborations in the future!