This November, Storebrand participated in the 2023 annual conference of the Platform Living Wages Financials (PLWF) in Utrecht, at which members of the collaboration assembled to cap the work done during the year with knowledge sharing and presentation of results.

Storebrand has been actively involved in the issue of living wages for many years. In 2021, we joined the PLWF, based on our recognition that achieving living wages requires detailed and dedicated cross-sector international investor collaborations over the long term. As such, 2023 marks the fifth anniversary of PLWF and of our engagements with companies.

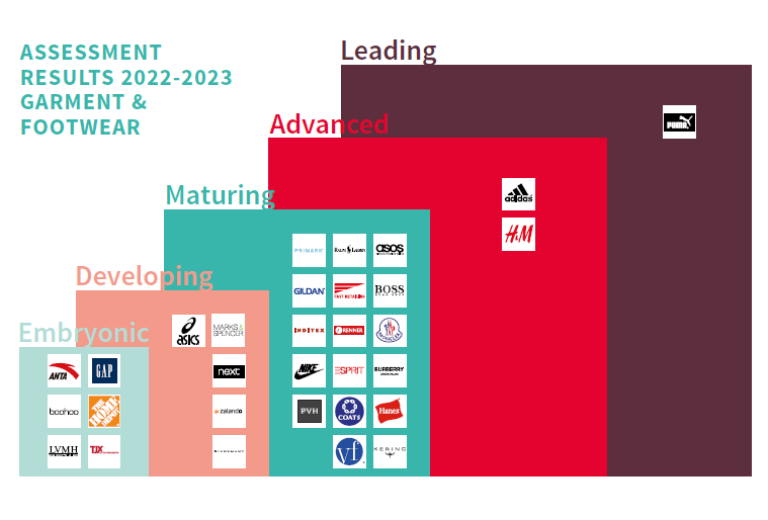

The PLWF brings together a group of approximately 20 investors to collaboratively engage with 52 investee companies on achieving living wages internally and in their supply chains. The PLWF’s workstreams focus on living wages in working groups defined by sector: garment & apparel, food & agriculture, and food retail.

The conference keynote speaker, Sally Smith of the Anker research Institute explained how a gender perspective is incorporated when estimating a living wage using the Anker methodology and provided guidance on investigating how living costs vary for lone parent households. The aim is to raise awareness of how gender issues can affect living costs (and therefore a living wage) and to draw attention to the possible need to develop targeted policies and strategies to support lone parent households in study locations where these types of households are common and are particularly vulnerable to poverty. Storebrand’s Tulia Machado-Helland presented the results of the engagement and assessment by the food and agriculture working group.

More critical than ever

While the topic of living wages has become more recognized over the past few years, progress has been slow on embedding the principles into corporate practices. A study released by the anti-poverty NGO Oxfam International in early January 2024 indicates that, of 1600 of the world’s largest and most influential companies they assessed, less than 0.4 per cent of the companies have publicly committed to paying their workers a living wage and support payment of a living wage in their value chains. [1]

The urgency of achieving living wages has grown in recent years, with rises in price inflation increasing the cost of living for most workers. The same Oxfam report estimated that more than 800 million workers worldwide saw their wages fail to keep up with inflation. With the gap to living wages widening in many sectors, this adds up to a setback in both the drive to reach living wages, and the drive to achieve many of the UN Sustainable Development Goals (SDGs).

Findings from our assessments of companies

Overall, the companies we had assessed showed improvement in 2023, on dimensions such as developing living wage and living income policies and practices – and they are integrating these topics within their responsible purchasing practices. The challenges identified in all three focus sectors, garment, food & agriculture, and food retail, remain the disclosure of data on actual incomes and income gaps in the supply chain. In addition, the initiatives on living wages and living incomes are still mostly small-scale and so it is time to upscale initiatives and implement programmes in day-to-day operations. Last but not least, complaint mechanisms and access to remedy are important, in order to ensure good practices “on the ground”. However, the assessment shows that most companies still fall short on actually implementing these mechanisms.

At the PLWF annual conference, as co-chairs of the Food & Agri and Food Retail working groups, Storebrand’s Head of Human Rights and Senior Sustainability Analyst Tulia Machado Helland and her counterpart from A.S.R. Asset Management, presented this year’s results from the working groups’ company assessment and engagement processes.

A common finding across both sectors that showed up in the results, is that there is still no evidence of living income gaps being closed in a structural and substantial manner. To help solve these deficiencies, what’s needed are need more time-bound targets; income and wage gap calculations; and higher farmgate prices. This is especially the case for supply chain workers.

However, the lack of time bound targets, gap calculations and evidence of living wages closing gaps also applies for own employees in the Food retail sector. Regarding their own employees, many Food &Agri companies that cannot document that they are paying a living wage, have many production plants around the world. Some companies are working towards ensuring living wages but only two companies had data to show that they have achieved it.